September 21, 2021

UPWARD TREND OF INTERNATIONAL OIL PRICES CONTINUES BEYOND COVID-19 LEVELS

Pohnpei, Federated States of Micronesia – The Federated States of Micronesia Petroleum Corporation (FSMPC) confirms that the second of three price movements scheduled for August, September and October 2021 has gone into effect Friday, September 10, 2021.

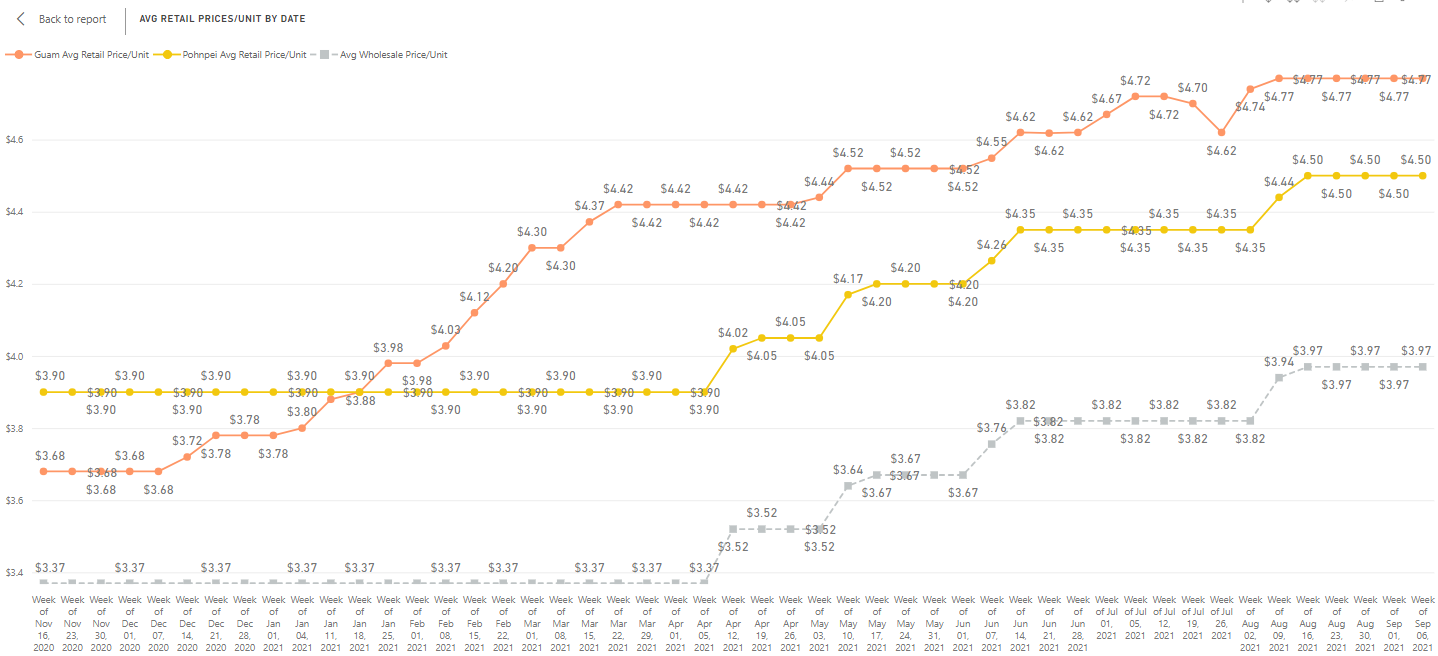

This second price movement of +$0.15/gallon affects the wholesale prices of unleaded gasoline (ULP), diesel (ADO) and kerosene (DPK) for Authorized Resellers, e.g. our Contract Service Stations in Chuuk, Kosrae, Pohnpei, and Yap, as well as our Walk-in Customers. As of September 17, 2021, the retail price of one gallon of unleaded gasoline across the FSM averaged at about $4.65, while the retail price in neighboring islands averaged at $4.77 in Guam, $5.00 in Majuro, and $5.12 in Palau. The difference between Guam and Pohnpei puts FSM retail prices beyond the stable pricing threshold within our pricing methodology.

FSMPC Business Analyst Ms. Sancherina Salle stated, “Our Pricing Team has been monitoring cost as well as regional and international oil prices, in the hopes that the second and possibly the third scheduled price increases might be deferred or altogether cancelled. Unfortunately, prices continue on this upward trend even beyond Pre-COVID-19 levels.”

FSMPC Chief Executive Officer Mr. Jared Morris suggested that there is hope beyond the continuously upward trend: “The Organization of the Petroleum Exporting Countries (OPEC) has already advised that in the coming months and on into early 2022, it plans to gradually resume production of large amounts of crude oil, which had largely been stalled because of serious drops in demand directly attributed to the cease in global activity brought on by the pandemic.”

As with other scheduled price movements in the past, CEO Morris advised of the possibility that the third and final planned increase scheduled for October 2021, may not come into fruition. “We are very closely monitoring trends in cost, retail prices, and other factors affecting price, and I am hopeful this September 10 price movement will be the last of the year.”

For inquiries, email info@fsmpc.com.